Adult Canadians do love online gambling. The most recent study on the subject says that 30% of Canadians hold a gambling account at some gambling website.

Which province has the highest number of gamblers? To answer this, we addressed the survey conducted by Ipsos from May 10 to 13, 2022 which interviewed a selected sample of 2,001 Canadians over 18 years old, to maximum reflecting the Canadian population based on the census parameters.

The revealed data shows that the Atlantic Canada region has the highest number of grown-ups registered to play on an online betting site which is estimated at 41%. British Columbia is tied with Ontario at 33%, Quebec follows the two provinces with 26% of the gamblers, Alberta indicated the figure of 24%, and Manitoba/Saskatchewan – 22%.

The average Canadian is usually registered with 3 or 4 websites. Atlantic Canada is the leader in the country as far as the number of websites used is concerned with an average of 4.7. Manitoba/Saskatchewan citizens do not show that inconsistency and normally stick to a lower number of sites – 2.7 on average.

Let’s go into detail to explain the figures stated.

Online Casinos vs. Sports Betting

One of the most evident recent trends in the Canadian online gambling market is an increase in online betting in general and in sports betting, in particular.

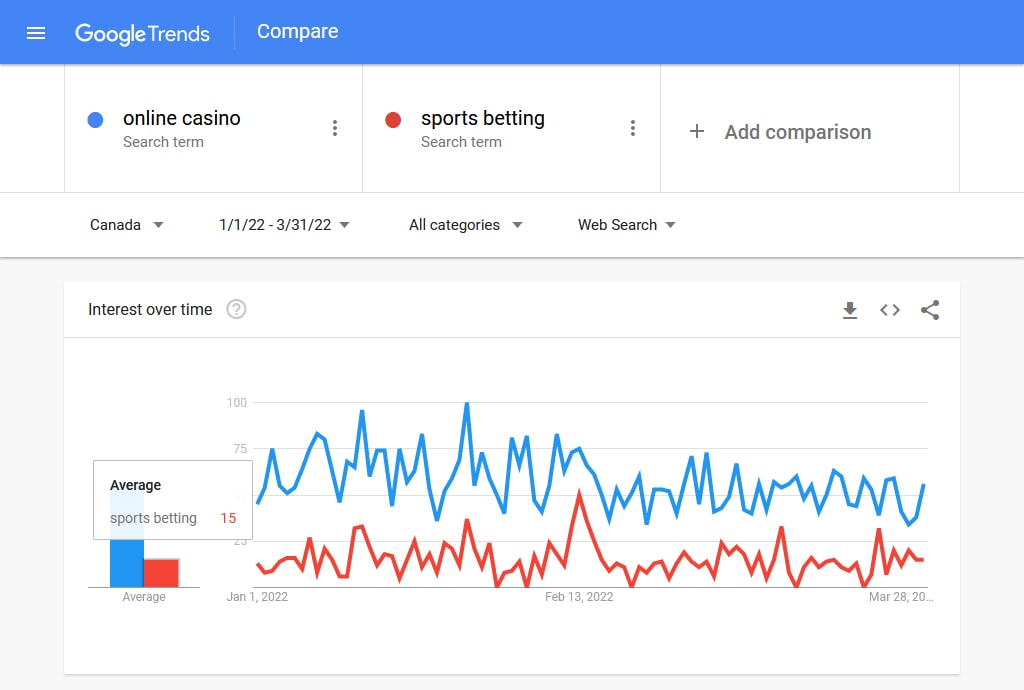

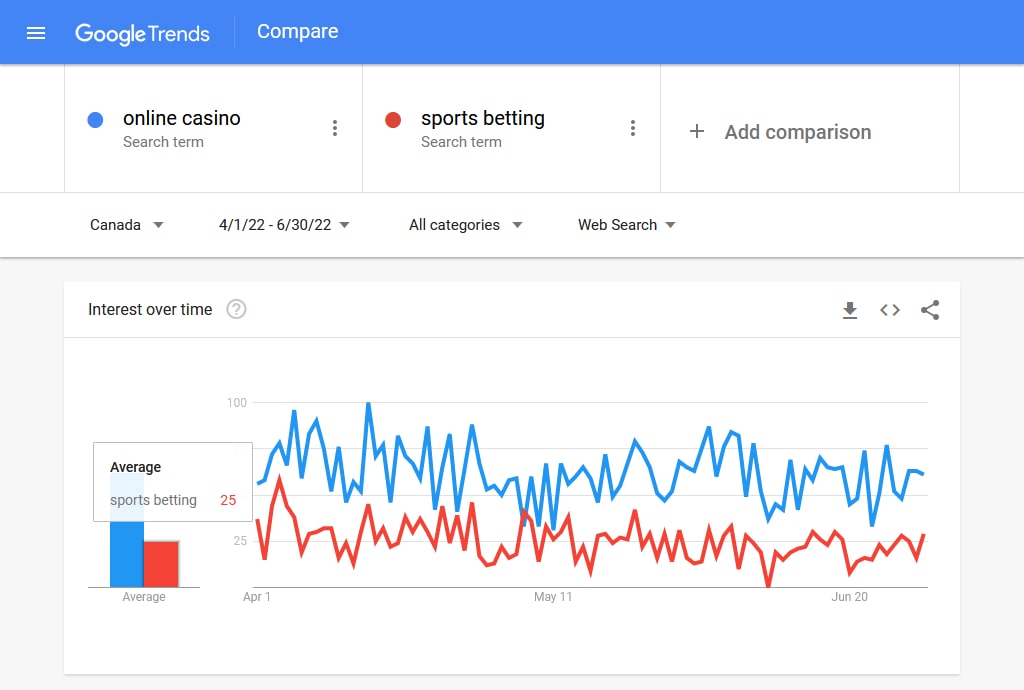

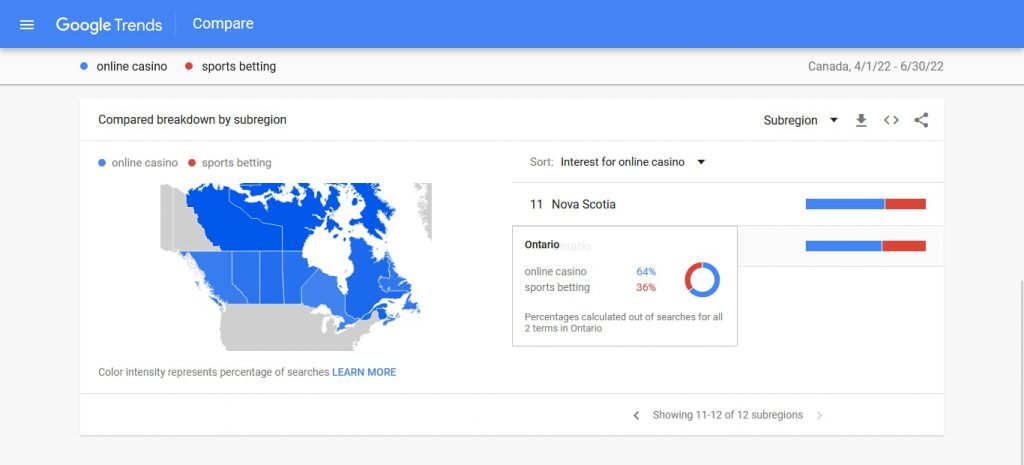

We have analyzed the two different terms representing 2 different areas of online gambling: ‘online casino’ and ‘sports betting’ using the Google Trends tool.

The findings say that 2Q period saw an increase in the Canadian population’s interest in both terms as compared to 1Q period. The ‘online casino’ average interest score grew insignificantly from 63 to 66. While the average interest score for ‘sports betting’ grew practically 1.5 times, having increased from 15 to 25 (see Pic.1, 2).

Pic.1

Pic.2

June demonstrated the lowest average interest score in regard to both terms as compared to the first two months of 2Q definitely due to the start of summer and change in people’s interests in general. In summer people tend to spend less time on the Internet devoting themselves to travelling, gardening, hiking, and the like.

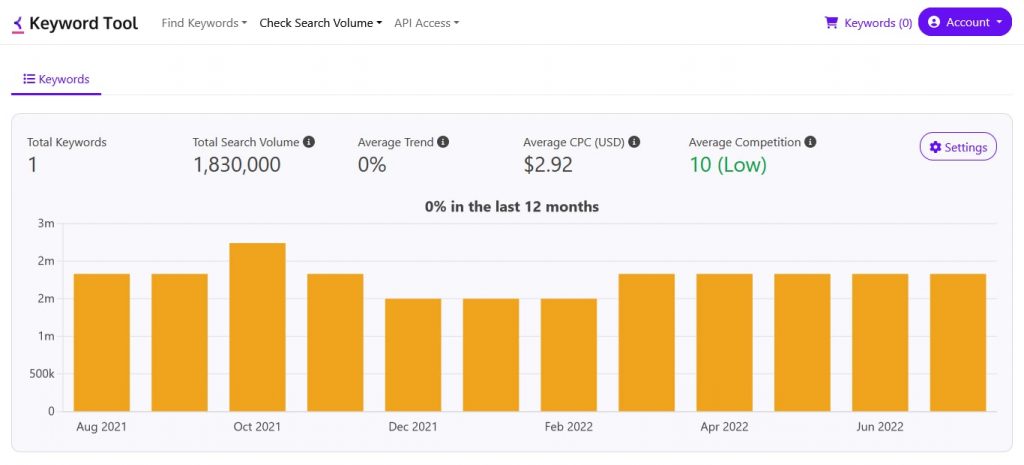

Another tool used for our research, keywordtool.io, also confirms this trend. The search volume for ‘sport(s) betting’ in the first two months of 2Q increased by 22% as compared to the last 2 months of 1Q (see Pic. 3), reaching 12100 in absolute value.

Pic.3

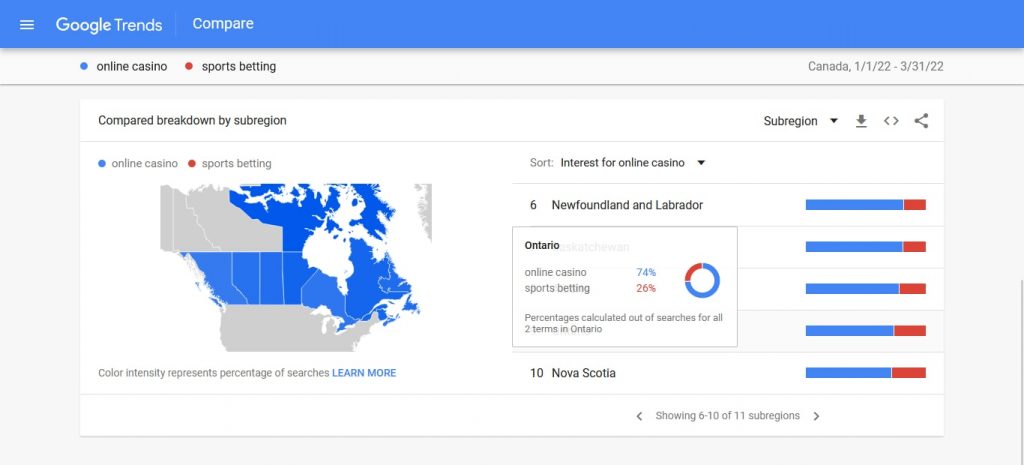

The most significant shift of interest from ‘online casino’ to ‘sports betting’ in 2Q among all Canadian provinces fell for Ontario.

So, turning to the Google Trends data, we can see that Ontario’s percentage of the search for the term ‘sports betting’ shifted from 26% in 1Q to 36% in 2Q which shows that sports betting significantly won the appeal from those in love with online casinos (see Pic.4, 5).

Pic.4

Pic.5

The entire Canada’s growth of interest in online betting can be easily explained by the launch of the legal Ontario online gambling market on April 4, 2022.

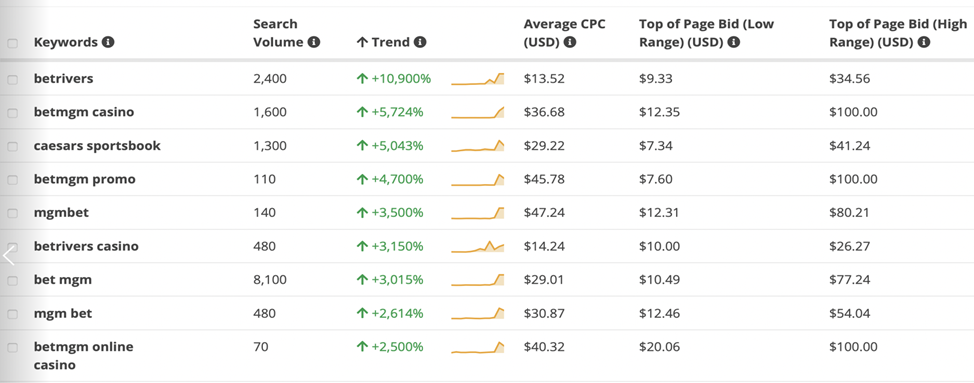

Once the first new fully registered and approved operators appeared in Ontario, the search for their brand names among Canadians flew to the sky. For some of them, increasing over 10,000%. (see Pic.6)

Pic.6

Although it’s been 3 months since Canada’s most populous province of Ontario legalized online betting, not all Ontarians are aware of it.

According to the above-mentioned Ipsos survey, only 41% of Ontario’s population know of the legal market that opened in Ontario. With this not impressive percentage, Ontarians are still more aware of regulation changes than the rest of Canada accounting only for 26% of the knowing ones.

Will this trend that we revealed still intensify due to the occurred legislation changes? Definitely, yes. It will become even stronger with the growing awareness of the total population of the country. We can judge so by reading an Ipsos press release which says that many of the surveyed who heard of the betting-related regulations change showed interest in making online bets in the next few months: 37% say they are definitely (17%) or probably (20%) to do some online gambling in the near future. These figures speak for a more substantial interest of those who are aware as compared to the unaware ones: only 14% say they’re definitely (5%) or probably (9%) to gamble online in the near future.

So, Ontario’s legislation changes created a powerful influx of sports betting options in the online gambling market and their number rises by the week.

With the market getting flooded with advertising for these new brands and online gambling apps both in Ontario and all over the country, Canadians appear to start paying attention and making more bets than ever.

The 18 new iGaming operators inundate the market with advertising and promotional messages encouraging players to sign up to a growing number of their official sites, thus, increasing the Canadian audience’s interest in them.

Further Law Straightening: Ads and Penalty Notices

The volume of online gambling advertising, that Canadians are being subjected to, has had a tremendous increase recently. This can be explained, on the one hand, by the flood of offerings that followed a change to federal law last summer, which made single-event sport betting legal and Ontario’s legalization of online betting. But, on the other hand, the Canadian market is still not that well-structured and developed. So, when it becomes more mature, there will be fewer ads and less frequency.

As well, all the provinces seek to clarify rules and standards related to the advertisement and marketing of ‘inducements, bonuses and credits’ by third parties. Ontario is particularly focused on advertising and inducements by affiliates and media partners that promote Ontario licensed operators.

Thus, hardly the iGaming market has become regulated, the Registrar of the Alcohol and Gaming Commission for Ontario (AGCO) has already served two AGCO-registered operators with Notices of Monetary Penalty for alleged infractions of the Registrar’s Standards for Internet Gaming. To be more specific, BetMGM Canada got a penalty of CA$48,000 and PointsBet Canada faced a penalty totalling CA$30,000.

A late June penalty was imposed by AGCO on another gambling operator DraftKings in the amount of CA$100,000. AGCO found DraftKings guilty of breaching Ontario’s rules on advertising and inducements, specifically Standard 2.05.

DraftKings turns out to have posted or aired multiple “broad gambling inducements,” including a promotion of boosted 2:1 odds, which was broadly distributed on television and social media, despite Ontario’s ban on such ads.

The standards are adopted to protect Ontario’s clients. They set forth clear restrictions on advertising of inducements, bonuses or credits; with the only exception when they are performed on an operator’s site or through direct advertising or marketing after getting the player’s consent.

The standards also state that all operator marketing, advertising and promotions must be truthful, and not mislead bettors with implications that their chances of winning will increase with the more money they spend.

Some Canadians Still Prefer Private Gambling Operators: Preference Statistics

Canadians still choose private gambling sites over provincial operators – say the findings of the survey conducted by Ipsos in May.

Around 44% of bets are placed on provincial government sites, while 56% of bets are made on commercial operator platforms. This happens because numerous so-called ‘grey market’ operators target players all over Canada are strongly competing against province-controlled gambling sites.

Thus, despite the fact that Ontario has just begun to offer legal online betting with companies other than the provincial government (OLG), many Ontario citizens have already registered and are making bets with private operators. The percentage of Ontarians signed up with private gambling operators is almost the same as the percentage of those registered with OLG.ca: 25% and 23%, respectively.

The other interesting statistics show that:

- In British Columbia, gamblers spent 33% of their bets with the government-supported BCLC’s PlayNow, while the rest sign up with private operators.

- Atlantic Canada gamblers spent 44% of their wagers at the local ALC.ca.

- Quebec is the only province where users prefer the government site: 57% go to Lotoquebec.com.

- The biggest audience preferring private operators is seen in Alberta and Manitoba/Saskatchewan, where gamblers say giving just 32% and 31% of their gambling dollars (respectively) to provincial government sites.

These lowest percentages can be explained by the fact that Alberta and Manitoba were among the last provinces in Canada to offer their population government-built online gambling sites. And Saskatchewan has not yet launched any at all.

How would one explain the private operator preference of Canadians? The thing is that they just seem to perceive no difference between government and privately operated gambling sites. (see Pic.7)

Perception of Government vs. Privately Operated Gambling Sites on Various Aspects

| Is trustworthy | Offers the best odds & payouts | Offers a wide range of activities to bet on | User frendly play experience | Easy to sign up and get started | |

|---|---|---|---|---|---|

| Goverment owned sites | 37% | 21% | 23% | 23% | 25% |

| Privately operated sites | 24% | 36% | 30% | 28% | 27% |

| Both about the same | 39% | 43% | 47% | 49% | 48% |

Pic.7

New Trend in Canada: Increase in Interest in Betting on eSports

According to the data revealed by YouGov in May 2022, there is a clear global trend in the growth of appetite for placing bets on eSports.

In accordance with YouGov’s Global Gambling Profiles tool that interviewed adults aged 18 and up, using a nationally representative sample, 10% of respondents from Canada say they’re interested in betting on eSports which is a significant proportion of the population.

Looking at the age groups, the findings reveal that one in every five consumers aged 18-24 in Canada is interested in betting on eSports. That number increases slightly among those aged 25-34 and decreases the higher we go up the age ladder.

North America, as a whole, is demonstrating a drastic increase in betting in general, thanks to law changes, and in eSports betting, in particular.

To explain it well, eSports is a type of competitive video gaming where players, who are, as a rule, professionals, compete in an organized tournament. Competitive gaming is now seen as a sport with its own competitions taking place in various countries.

This once-upon-a-time small industry has developed so significantly within a decade or so that prizes for competitors in the most prominent international contests can reach millions of dollars with millions of fans tuning in.

Definitely, eSports are growing in popularity thanks to sports betting sites that nowadays provide their clients with the opportunity to bet on eSports alongside traditional sports.

Since sports betting has become increasingly popular in Canada, eSports betting is expected to follow the same trend within the next several years, as calculated by many industry observers.

Indeed, eSports betting presents an excellent opportunity for both the video gaming industry, which can further increase its profile in the mainstream, and the gambling industry, which can achieve new revenue levels in the coming years.